Rajkotupdates.news : tax saving in fd and insurance tax relief

As rajkotupdates.news : tax saving in fd and insurance tax relief the tax season approaches, it’s important to plan ahead and maximize your tax savings. One way to do this is by investing in financial products such as fixed deposits (FDs) and insurance policies. These options not only offer attractive returns but also provide tax benefits that can significantly reduce your taxable income. In this blog post, we’ll share our top 5 tips for maximizing your tax savings through FDs and insurance so you can keep more money in your pocket come tax time!

Understanding Your Options

When it comes to maximizing your tax savings, the first step is to understand your options. In India, there are a variety of financial products that offer tax benefits such as FDs and insurance policies.

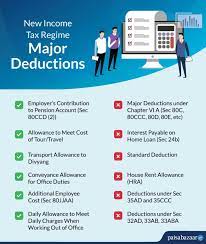

Fixed deposits (FDs) are a popular investment option because they offer guaranteed returns and low risk. They also come with tax benefits – interest earned on FDs is subject to TDS (tax deducted at source), but you can claim deductions under Section 80C of the Income Tax Act for investments up to Rs. 1.5 lakh per annum.

Insurance policies, whether life or health insurance, not only provide financial protection but also offer tax benefits. Premium payments made towards these policies are eligible for deductions under Section 80C and Section 80D respectively.

It’s important to carefully consider your options before investing in any financial product as each one has its own set of pros and cons when it comes to both returns and taxes. By understanding your options, you’ll be able to make informed decisions about where to invest your money for maximum tax savings!

Choosing the Right Financial Products

Choosing the right financial products is essential in maximizing your tax savings. With so many options available, it can be overwhelming to determine which one is best suited for you.

First and foremost, consider your financial goals and risk tolerance. If you’re looking for a low-risk investment option with guaranteed returns, fixed deposits (FDs) may be the way to go. On the other hand, if you’re willing to take on more risk for potentially higher returns, mutual funds or stocks may be a better fit.

It’s also important to consider the tax implications of each product. FDs offer tax-saving benefits under Section 80C of the Income Tax Act up to Rs 1.5 lakh per annum. Additionally, interest earned from FDs is taxable as per your income bracket.

Insurance policies such as life insurance or health insurance not only provide coverage but also offer tax benefits under various sections of the Income Tax Act.

Don’t forget about retirement planning! Retirement plans such as Public Provident Fund (PPF) or National Pension System (NPS) are excellent options for long-term investments that offer both savings and tax benefits.

In summary, choosing the right financial products requires careful consideration of individual financial goals and preferences while keeping in mind their respective tax implications.

Maximizing your Tax Savings with FDs and Insurance

When it comes to maximizing your tax savings, two financial products that come to mind are Fixed Deposits (FDs) and Insurance. Both of these options not only help you save on taxes but also provide long-term benefits.

Fixed deposits are a popular investment option for many people because they offer guaranteed returns and have low risk. Moreover, interest earned on FDs is taxable under “Income from Other Sources.” However, the government allows up to Rs 10,000 in interest income per annum as an exemption under Section 80TTB for senior citizens.

Insurance policies like life insurance and health insurance allow you to claim deductions under different sections of the Income Tax Act. For instance, premiums paid towards a life insurance policy can be claimed as deductions up to Rs 1.5 lakh under Section 80C of the act.

Moreover, with medical costs rising significantly every year, buying health insurance has become increasingly essential. Not only does it protect your finances during times of illness or injury but also helps you save on taxes with deductions up to Rs 25,000 annually under Section 80D of the act.

Choosing the right mix of FDs and Insurance can go a long way in helping maximize your tax savings while securing your future financially.

Preparing for Taxes Year-Round

Preparing for Taxes Year-Round

Taxes are not just a once-a-year affair. In fact, preparing for taxes should be done throughout the year. By keeping track of your income and expenses, you can maximize your tax savings and avoid any surprises come tax time.

One way to prepare for taxes year-round is by keeping detailed records of all your financial transactions. This includes receipts, invoices, bank statements, and other important documents that show how much money you earned and spent throughout the year.

Another important aspect of preparing for taxes is staying up-to-date with changes in tax laws. Tax rules can change from year to year, so it’s crucial to stay informed about any new regulations or deductions that might affect your tax situation.

You may also want to consider consulting with a financial advisor or accountant who can help you develop a comprehensive tax strategy tailored to your unique needs and goals.

Don’t forget to take advantage of any available deductions or credits that could lower your overall tax bill. From charitable contributions to education expenses, there are many ways to reduce the amount of taxes you owe each year – as long as you’re prepared!

Conclusion

In a nutshell, maximizing your tax savings through FDs and insurance is an excellent way to manage your finances effectively. By understanding the options available to you, choosing the right financial products, preparing for taxes year-round, and seeking professional guidance when necessary, you can save money that could be used towards other essential things.

Remember that saving on taxes does not mean cutting corners or evading payment of dues. Instead, it means exploring legal ways to reduce your tax burden while making smart investment decisions.

With these top 5 tips for maximizing your tax rajkotupdates.news : tax saving in fd and insurance tax relief savings through FDs and insurance in mind – start planning today! With careful consideration and proper execution of these strategies outlined above, you’ll soon find yourself reaping substantial benefits in terms of reduced taxes while ensuring a secure financial future.