Anyone considering taking a loan should first consider the expense of doing so. If you need to borrow money, you’ll hunt for the lowest interest rates feasible. On the other hand, a high-interest rate will be favorable to investors.

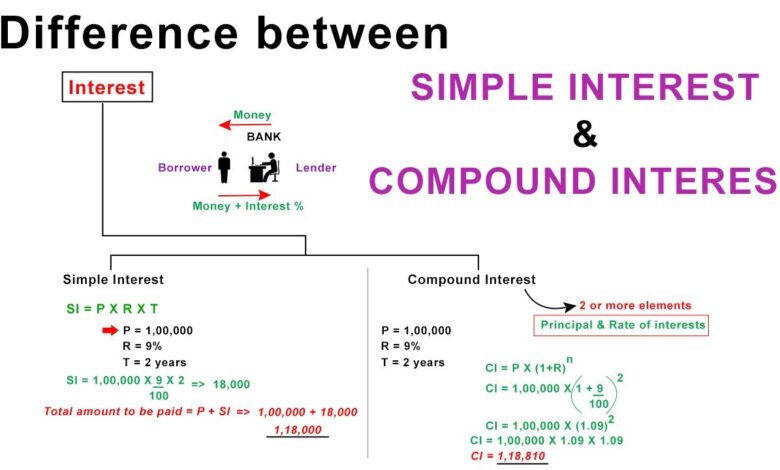

When a borrower takes out a loan from a lender, financial institution, or bank, they are charged a fee on top of the total amount borrowed. An interest rate is a phrase used to describe this additional amount. Compound interest and simple interest are two types of interest that may be levied. Simple interest is solely computed on the loan amount, while compound interest is calculated on the loan amount and the cumulative interest.

In a nutshell, simple interest is the amount paid for the money borrowed for a certain period. In the case of compound interest, the interest is added back to the principal amount whenever it is due for payment. Read on to understand the detailed distinction between compound interest and simple interest in this article.

Simple interest

Simple interest is calculated as a percentage of the initial amount loaned or principal for the whole borrowing period. The price paid for the usage of money or the revenue earned from lending the funds is referred to as interest. It is the simplest and quickest technique for calculating interest on a loaned or borrowed money. The vehicle loan is the most prominent example of simple interest, in which interest is paid only on the initial amount leased or borrowed. The amount of interest is calculated using the given formula:

Interest is calculated using the following formula: Simple Interest = Pin

Where P stands for Principal Amount.

n = number of years

I = interest rate

For example, if you borrow Rs. 1000 from a friend for three years at a rate of 10% per year, you must repay Rs. 1300 to your friend at the end of the third year, including Rs. 1000 in principal and Rs. 300 in interest for retaining the money. The total is known as the amount when the principal and interest are added together. Keep in mind is that the bigger the money and the longer the term, the higher the interest.

Compound interest

Compound interest is interest calculated as a percentage of the updated principal, i.e. the original principal plus the previous period’s accrued interest. We add the interest gained in past years to the original principal in this way, increasing the principal amount on which the interest for the following year is charged. The principal and the interest accumulated over the loan period must be paid in this case.

Banks usually pay interest every six months, whereas financial institutions pay interest every three months. You can use the following formula to calculate compound interest:

Compound Interest = P(1 + i)n – 1 is a formula for calculating compound interest.

P is the principal, n is the number of years, and I is the annual interest rate.

Compound interest and simple interest: What’s the difference?

The fundamental distinctions between compound interest and simple interest are as follows:

- Simple interest is the interest imposed on the principle for the whole loan period. Compound interest is interest calculated on both the principal and previously earned interest.

- When compared to simple interest, compound interest yields a higher return.

- The principal in simple interest stays constant, but the principal in compound interest changes due to compounding.

- Simple interest grows at a slower pace than compound interest.

- Simple interest is easy to calculate, but compound interest is more complicated.

Interest calculation & personal loan at Bajaj Finance

Personal loans are an excellent choice for folks who desperately need funds in an emergency. They are freely accessible, both offline and online, as unsecured forms of debt with few restrictions on the loan amount.

You are called a defaulter if you do not pay your loan EMIs on time. However, bear in mind that some loan providers include a ‘grace period’ that starts immediately after your EMI due date. If you make your loan payment within the grace period, you may be compelled to pay Bajaj Finserv EMI overdue charges to avoid being labelled a ‘defaulter.’

Your credit score is one element that affects your eligibility for a personal loan. You can get an instant loan for low CIBIL score.

Contact the Bajaj Finance helpline number if you have any questions. Using the branch finder, you may visit any of our locations. SMS the word “SOL” to 9773633633.

Conclusion

Interest is essentially a cost for borrowing money from someone else. Risk, inflation, time worth of funds (compounding impact), and opportunity cost are among the reasons for paying interest.

Simple interest is simple to compute, as seen in the formula above, whereas compound interest is complicated to calculate. When we add both simple and compound interest for the same period, rate, and principal as in the preceding example, compound interest is always larger than simple interest owing to the compounding effect, commonly known as the time value of money.

Understanding the differences between these two approaches will help you choose the finest loan and the best way to save your money. Bajaj Finance loan is the best option for EMI. Bajaj Finserv EMI overdue charges are also less compared to others. You can get an instant loan for low CIBIL score. For any help, you can contact the Bajaj Finance helpline number.

Additional Read: Apply for Personal Loans from Top NBFCs such as Bajaj Finserv

Go to Homepage