Credit Information Bureau (India) Limited (CIBIL)

India’s first credit information company, TransUnion CIBIL Limited, was founded in 2000. It was formerly known as Credit Information Bureau (India) Limited. It gathers and maintains data on business and individual credit, including information on loans and credit cards. Periodically, member institutions send these records to the credit bureau. The bureau uses the data to produce credit reports and assign credit scores. It’s crucial to remember that CIBIL is a database of credit data. No loan decisions are made by the credit bureau. It only offers information to banks and other financial organizations, which use it to screen loan and credit card applicants.

History of CIBIL:

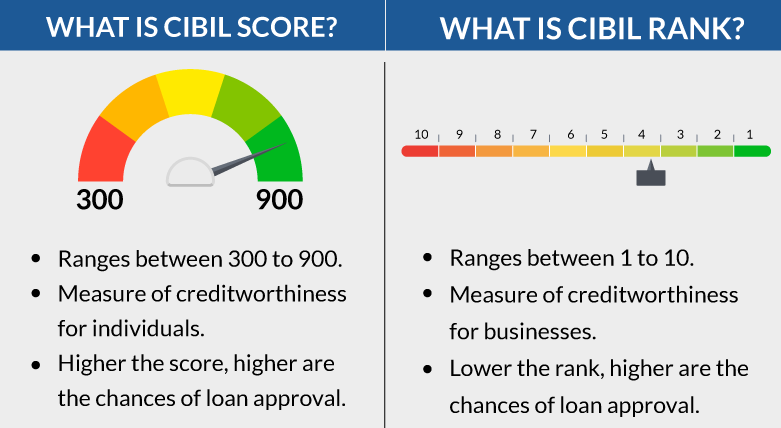

You must question yourself, “What is my CIBIL score?” while applying for a loan. Will I also be creditworthy? Your bank will create a credit report and use your credit history to assess your creditworthiness. The repayment of debts by a borrower is documented in their credit history. A credit report is a summary of a borrower’s credit history obtained from a variety of institutions, including banks, credit card companies, collection agencies, and governmental bodies. A mathematical method used to analyze credit data and forecast creditworthiness produces a borrower’s credit score.

It typically takes between 18 and 36 months of credit utilization, or longer, to achieve a good credit score with a CIBIL report. Credit Information Bureau (India) Limited was established in Mumbai, Maharashtra, 17 years ago. The major turning points in the credit bureau’s history are shown here. Because of the RBI Siddiqui Committee’s recommendations, TransUnion CIBIL Limited was established in 2000.

- 2004 saw the introduction of credit bureau services in India (consumer bureau). Commercial bureau started working in 2006. The first risk scoring model for financial institutions in the nation, the CIBIL Score, was developed in 2007.

- 2010 saw the introduction of CIBIL Detect, the nation’s first database for high-risk activities, and CIBIL Mortgage Check, its first centralized mortgage database.

- 2011 saw the release of the CIBIL Score for individual consumers. TransUnion acquires an 82 percent share in CIBIL in 2016 to form TransUnion CIBIL.

- TransUnion CIBIL launched the CIBIL MSME Rank in 2017 to increase credit penetration in small and medium-sized businesses. TransUnion buys out CIBIL’s 92.1 percent ownership.

Still not cleared with CIBIL Score meaning, don’t worry. Let’s understand:-

How CIBIL functions:

TransUnion CIBIL obtains monthly information about your loans and credit card payments from financial companies. Lenders use your credit report and credit score, which are generated by CIBIL based on the information you submit, to assess your financial stability. The CIBIL reports and ratings are very important to your financial journey and should not be taken lightly. They determine your qualification for credit cards and loans. Those with good credit scores are also more likely to get larger limits approved by financial organizations. Regarding setting interest rates, CIBIL scores have a significant impact as well. You can obtain grants and reduced interest rates by having a high CIBIL score. Wondering how to check CIBIL Score ? Don’t worry we got all of it covered.

Who determines Credit Scores?

Your credit rating is determined by:

Banks transmit information about transactions you make to all four credit bureaus when they are important to determining your credit score. The RBI has mandated that information be sent to each credit agency. Banks inform Credit Information Companies about your spending patterns. Any of the bureaus can be contacted by a bank if they need to check an online credit score. It makes no difference which one you choose because they will all receive the same grade from you because they are all equally credible and equal in value.

Credit bureaus begin gathering additional data about your financial habits from other banks and financial organizations after receiving information from the bank.

Why should I check my Credit rating?

You must pay great attention to your credit score, which is highly significant. It is the most accurate technique to assess your likelihood of receiving a credit line. You should monitor your score in order to find out if it dips or if credit bureaus made a mistake when calculating it. This will enable you to promptly make corrections.